1. History

1.1 British Airways

Being the flag carrier airline of the United Kingdom, British Airways plc (BA) has emerged to become the largest airline of the UK, based on fleet size, international flights, and international destinations. Waterside that is close to its major hub at London Heathrow Airport is the headquarters of BA. London Gatwick Airport is another hub of it. Its all straight overseas flights have been made through only Heathrow, Gatwick and London City Airport since the sale of BA Connect to Flybe in 2007, as it has terminated these flights from the UK’s other airports. It has become essential for BA’s UK passengers coming from non-London airports to make use of different airlines with direct services or have to connect through London.

In 1971, the British Board was established to control nationalized airline corporations, BOAC and BEA, and two regional airlines, Cambrian Airways and Northeast Airlines. In September 1974, the British Airways group was formed, as all these four companies were dissolved to materialize British Airways. As part of the privatization plan of Conformist Government, British Airways was privatized in Feb 1987. With this action, BA aggressively took consolidating approach by merger and acquisitions. Thus in the same year, British Caledonian was acquired and then later in 1992, Gatwick-based carrier Dan-Air was also acquired. British Airways is part of Oneworld airline alliance that has emerged to become the third largest airline alliance, whereas SkyTeam and Star Alliance lead the race. The founding member airlines of Oneworld airline alliance include British Airways,

American Airlines, Cathay Pacific, Qantas and the obsolete Canadian Airlines (Ameinfo, 2010).

The merger of Iberia with British Airways that was completed on January 21st 201, lead the creation of a new group, the International Airlines Group, IAG on the map of airline transport industry (Centerforaviation, 2011).

1.2 Iberia airlines

Iberia, flying to 112 destinations in 46 countries and offering other 120 destinations through codeshares with other airlines, has become Spain’s largest air transport group and the fourth-largest in Europe. Flying almost daily to 19 destinations on the routes between Europe and Latin America, Iberia has become the leading airline on this route. Madrid airport’s Terminal 4 is its main operating base, also works as the gateway between Europe and Latin America. Iberia moved its operation to this place in February 2006. it must be noted that Iberia along with its affiliates and other airlines of the group well represents in Barcelona. In addition, Iberia having distinguished services to society has become the part of the only three airlines of Dow Jones Stoxx Index.

Iberia with the old name of Compañía Aérea de Transportes commenced its commercial operations in December 1927. However, it was incorporated on 28 June 1927. During the Dictatorship period, it was merged into Compañía de Líneas Aéreas Subvencionadas S.A. and ceased its commercial activities on 29 May 1929. After the civil war, it emerged to be a purely domestic airline. In 1944, it became part of INI by nationalization. In 1946, it started to fly between Europe and South America after WWII. Iberia faced huge business growth due to the pact of Madrid in 1953 which eliminated visa requirements for US visitors to Spain and thus the transatlantic flights between Spain and the United States increased manifolds. During 2001, Iberia’ shares were listed on the stock exchange after it was privatized in the same year (Iberia Group, (2010). In 2005, after the inclusion of Airbus A340 aircraft into its fleet, Iberia introduced its new Business Plus Class. After capturing of Terminal 4 at Madrid Barajas and becoming part of Oneworld alliance members in 2006, it got much-needed expansion capabilities and now it alone is responsible for about 60% of Madrid Barajas traffic (Oneword, (2011).

2. Pre-merger Structure

2.1British Airways:

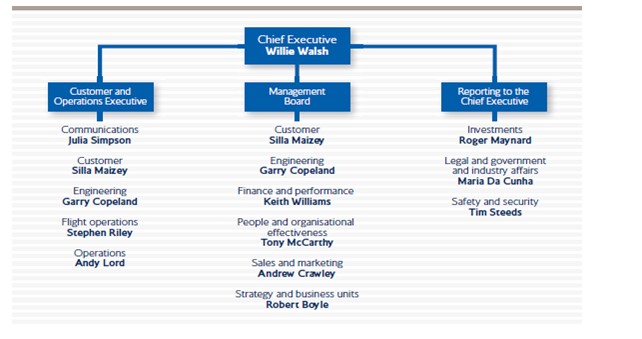

The pre-merger structure of the organization is flat type as it has only one level of the hierarchy that separates Chief Executive at the top from bottom-line employees (Buchanan D. & Huczynski A., 2004). Under this functional arrangement, Chief Executive who leads the executive management of the company is accountable to the Chairman who leads the board. During the last year, BA took a restructuring plan which included the organization of top management team comprising nine directorate heads, led by the Chief Executive. Now there are two groups at the top management- the Management Board and Customer Operation Executive. The weekly meeting of the Management Board decides about the vision and strategic direction of the Company. The Customer and Operations Executive looks after day-to-day customer service and operational performance by ensuring the highest standards of safety. This group also meets weekly. It must be noted that legal, director of safety and security and director of investment directly report to the Chief Executive (BA, (2009).

This arrangement is not spontaneous as clock-like behavior is valued throughout the organization. For efficiently running the scheduled premium airline, it is necessary that the planes must be operated safely and efficiently. BA thus follows very rigorous procedures and safety measure to ensure proper maintenance and training. Furthermore, BA is featured with a high degree of formalization and standardization as only one or two serious accidents can damage the reputation of the airline (Anonymous, (2004).

Moreover, BA is also continuously striving for emerging as a leaner organization with a distinctive and high-performing culture. To bring such changes to the work at BA, they have launched a flagship change programme, Compete for 2012 (BA, (2009).

Read More:

- JETBLUE SUSTAINABLE COMPETITIVE ADVANTAGE

- NIKE CASE ANALYSIS

- International Marketing Report and Promotional Strategies

2.2 Iberia Airlines:

The management structure of Iberia is also functional and hierarchical which also has some sort of bureaucratic style in it. The non-director Secretary is the legal advisor to the Board and responsible for overseeing the formal and material legality of its resolution. He also ensures the rules of good governance. The Board of Directors comprises of twelve members, two are executive directors-the Chairman of the Board, also Executive Chairman-and the CEO, and ten non-executive directors. Of rest of the ten non-executive directors, four are independent as they have no influence in the control of the company, five are proprietary directors which have proposed shareholders having sufficient interest in the company, and one is a non-executive non-proprietary director (Iberia Group, (2010).

Pre-Merger Structure of British Airways vs. Iberia Airline:

| Factors | British Airways | Iberia Airlines | Similarity and Differences |

| Organizational Structure | Lean and Flat and functional | Flat and functional as well as business units | BA’s and Iberia’s organizational structures do match with each other to some extent; however, Iberia has a function arrangement that suits its three business divisions. |

| Strategic Vision | Leading Global Premium Airline | leader in customer satisfaction, innovation, and economic and social performance | The strategic directions of both of the group organizations differ a lot. In fact, BA has the well-defined business segment of passengers who want extra services whereas Iberia’s business divisions such as passengers & cargo traffic, maintenance, and handling services require different innovative solutions. |

| Major Businesses | 87% business comes from passenger traffic, 7% from cargo and 6% from other activities. it is a major long haul-North Atlantic carrier

|

Besides passenger and cargo services, it offers aircraft maintenance, handling in airports. A major is long haul-South Atlantic carrier | The major chunk of business for both companies comes from passenger traffic, however, Iberia has bit diversified revenues stream that comes from aircraft maintenance and handling services provided to different airline companies at airports. In addition, their long-haul routes also vary from North-Atlantic to South-Atlantic. |

| Destinations | more than 148 destinations Americas: 38 • UK: 9 • Europe: 67 • Africa: 15 the Middle East and South Asia: 12 • Asia Pacific: 7

|

almost 120 destinations in 45 countries (38 domestic + 82 international) | Contrary to Iberia Airlines, BA is the global airline which has its destinations in almost all continents of the world. |

| Subsidiaries | CityFlyer, OpenSkies, and Franchisees: Comair (South Africa) and

Sun Air Scandinavia (Denmark). |

Vueling and franchising partners: Iberia Regional/Air Nostrum | Iberia has a 20% stake in low-cost carrier Clickair based in Barcelona. It must also be noted that The merger between Vueling and Clickair also took place in July 2009. CityFlyer, OpenSkies present competitive environment for low-cost carriers such as Ryanair and Easyjet. |

| Fleet Size | 245 aircrafts | 109 aircrafts | BA’s fleet size is almost two times the Iberia’s fleet size, which represents its strength in the international airline industry. |

| No. of Passengers | More than 33 million passengers in 2009 | 25 million passengers carried during 2009 | No. of passengers carried during the year by both airlines does not present significant difference, however, a difference is wider in case of domestic and international passengers carried. |

| Alliance | Oneworld | Oneworld | Three members of the Oneworld alliance, namely American Airlines, British Airways, and Iberia Airlines have signed a joint business agreement to expand their codeshare arrangements on flights within and beyond the EU and U.S. |

| Type | Flag Carrier | Flag Carrier | Both airlines are flag carrier national airlines of U.K and Spain respectively. |

| Ownership | Holds 9.89% stake in Iberia Airlines | Iberia holds 9.9% shareholding in BA | BA has 13.15% voting right in Iberia Airlines which has remained unchanged over the last year. |

British Airways, (2009), Iberia, (2009)

3. Success Factors for competitive advantage:

IAG-British Airways and Iberia Airlines

As BA and Iberia have been merged under the holding company of International Airlines Group, this consolidation will mark the most of the future success of both of the companies in the era of consolidation and unprecedented threats from low-cost no-frill airlines around the world. IAG has emerged as a Europe’s third-largest and the sixth-largest in the world by revenues. With a fleet of 406 aircraft and 55 million passengers, this airline group will create a combined network of 204 destinations around the world. Now the British Airways and Iberia have combined competencies to compete with other leading groups such as Air France-KLM and Lufthansa AG in Europe (IAG, 2011).

The both of the merged airlines will be able to reap the benefits of synergies that would arise from 60% of cost savings and 40% from larger revenues. Thus the group as a whole will have a hedge against the surging oil prices in the international oil market (Dan Milmo,(2009).

This joint-business agreement would also open new doors for Iberia to expand the network of its long-haul South Atlantic destinations to Asia, where BA is well established. On the other hand, Iberia’s dominance in Latin America and 19 other destinations would also present more options for travel to Latin America for BA’s customers. It is also expected that this join business partnership among the two flag carriers would create combined fares. In this way, more than 120 VIP lounges will be accessible to passengers. Furthermore, their frequent flyer programs would also gain momentum from the coordination between Iberia Plus and BA’s Executive Club (Clinton Manning, (2010).

As the increasing competitive war and cost-pressures have moved the airline industry towards consolidation through some regulatory restrictions still prevail, IAG clearly creates the hedge for the future survival and consistent performance for both of the airlines. It will further reap the benefits of this consolidation, as the low-cost airlines also face trouble in the face of shrinking profit margins (Duedden, Jan Christoph. (2005).

Oneworld Alliance and Past Relationship between BA & Iberia:

Being part of Oneworld Alliance, the third largest airline alliance, BA and Iberia have cooperated a lot with each other for a decade or so. In addition, now they have signed a new business deal among themselves and American Airlines to expand their codeshare arrangements on flights within and beyond the EU and U.S…

Their past practices as shareholders and joint-business partners have also contributed a lot to their success in EU and Latin America. This relationship also ensured a consistent profitability and competitive advantages for each other in their respective target markets. In addition, this relationship also served as a hedge against the big rivals in the EU and American airline industries (Iatrou, Kostas. (2004).

It has also been observed the prevalent co-operation of both of the airlines especially on the Spain-to-UK routes; however, the low-cost carriers still hold the dominant position over there. Furthermore, they had a good opportunity in the past to compete effectively with other airlines on their non-overlapping long-haul routes. Thus their new joint-business merger would enable them to have some sort of defensive wall against the surging competition from other major airlines especially the low-cost no-frill airlines (Porter, M.E. (1980).

Brand Image of Both Organizations:

BA being the leading Premium airline in U.K and the rest of the world has got a lot of success and consistency in its profitability despite the cut-throat competition from low-cost no-frill airlines and emerging Asian and American rivals. In the past, it made a continuous addition of long-haul flights as well as the expansion of its fleet to hold its dominance and give the unique experience to its customers throughout the world. BA’s special features such as extended leg room, special lounges and onboard catering with exclusive wine created huge differentiation for BA’s premium brand (Rhoades, D.L. (2006).

On the other hand, Iberia has held a dominance position in the foreign travelers’ chosen country, Spain through its domestic subsidiaries and franchise operations. Further being a national airline and flag carrier, Iberia has remained a choice for the Spanish people traveling between Spain and Latin America.

Success Factors Comparison:

| BA | Iberia |

| Premium Brand image throughout U.k. European countries | National Airline of Spain and Flag Carrier |

| Change management programs and continuous improvement | Backup support of airline handling and other maintenance services |

| International presences and long-haul destinations through continuous addition of new aircrafts | Dominance in Latin America and the domestic market of Spain |

| Oneworld alliance | Oneworld alliance |

| Domestic presences through low-cost subsidiaries | Domestic presences through low-cost subsidiaries |

| Strong foothold at Heathrow Airport especially the enhanced services at Terminal 5 | Madrid and Barcelona |

References:

- Rhoades, D.L. (2006), “Growth, customer service and profitability Southwest style”, Managing Service Quality, 16 (5) , pp.538-547

- Anonymous, (2004), “Industrious times at British Airways and Ryanair:Winning the battle for skies”, Strategic Direction, 20(4), pp. 4-6, [Online] Available at: http://www.emeraldinsight.com.ezproxy.scu.edu.au/journals.htm?issn=0258-0543&volume=20&issue=4&articleid=869434&show=html Last accessed 25th Jan, 2011.

- Oneword, (2011), “Members-airlines”, [online] Available at:

http://www.oneworld.com/ow/member-airlines/iberia#oneworld-status

- Duedden, Jan Christoph. (2005), Consolidation and its Implications for direct long haul travel, ATRS World Conference, Rio de Janeiro, Brazil.

- Iatrou, Kostas. (2004). The Impact of Airline Alliances on Partners’ Traffic, Cranfiel University.

- Salama, A. & Easterby-Smith, M., (1994), Cultural Change and Managerial Careers, Personnel Review, 23 (3): 21-33.

- Buchanan, D., & Huczynski, A., (2004), Organizational Behaviour: An Introductory Text (5th edn), Essex, Pearson Education Limited.

- Clinton Manning, (2010), British Airways merger at the gate, Mirror News, [online], Available at:

- Porter, M.E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. New York: The Free Press.

- Iberia Group, (2010), [online] Available at:

http://grupo.iberia.es/portal/site/grupoiberia/menuitem.01a5101a2600f259f54c0f10d21061ca/

- Ameinfo, (2010). [Online], Available at:

http://www.ameinfo.com/175880.html

- Robert Caleo , (2010). The success of British Airways, Chassell, [online], Available at: http://www.chassell.net/index.php/outdoor_sports_recreaction/the_success_of_british_airways

- Dan Milmo,(2009),Q&A: Iberia British Airways merger, Gurdian, [online] available at: http://www.guardian.co.uk/business/2009/nov/13/implications-iberia-ba-merger

- Centerforaviation, (2011), [online], Avialable at: http://www.centreforaviation.com/news/2011/01/26/british-airways-and-iberia-merger-completed-planning-to-add-more-airlines-to-the-group/page1

- IAG (2011), [online] Available at:

- BA, (2009), Annual Reports, [online], Available at:

http://www.iairgroup.com/phoenix.zhtml?c=240949&p=irol-reportsannual

Appendix