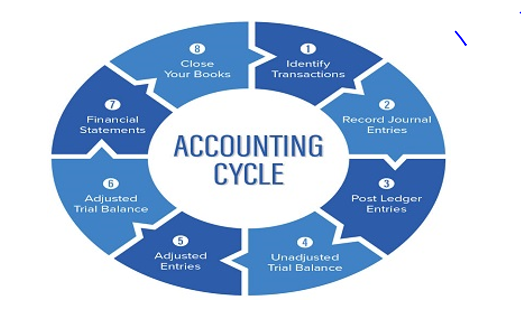

The accounting cycle is a systematic eight-step method. It checks, records, and tests a company’s financial activity and transactions. It is a process to accept, note, compile, and credit payments. Hence, A business makes and receives the charges during a certain billing cycle. It starts with the closing of a transaction.

Moreover, it finishes with the preparation of annual financial reports. Most students find it hard to complete an accounting cycle assignment in the given time. Need help with the accounting cycle diagram? Accounting assignment helper UK is here to sort out all your challenges.

How Does the Accounting Cycle Work?

The accounting cycle is a set of rules for financial statements to be useful and valid. A unified accounting cycle diagram and computerized accounting systems help reduce mathematical errors. The accounting cycle is now automated by accounting software. It results in less human work and fewer errors related to manual processing. This article will help you learn the accounting cycle via an accounting cycle diagram. Accounting assignment help UK resolves all accounting issues for students in UK.

Accounting Cycle Steps

Step 1: Identifying and recording transactions

The very first step is to record. It is an essential step in the accounting cycle. Bookkeeping is an art in which the author records each transaction.

However, Businesses have many trades throughout the accounting cycle. Therefore, Each must be recorded in the company’s books.

Recordkeeping is necessary for recording all types of financial transactions. Monthly and yearly invoicing periods are available for postings.

step 2:Preparing journal entries

The cycle’s second phase is preparing log entries. It is to record non-routine accounting operations. You can also use journal entries for editing. Use automated journal entries whenever possible.

Businesses must remain attentive to their spending. It varies on whether they use accruals or cash accounting. It is important to remember that accrual accounting requires income to equal expenses. So, both must be recorded at the moment of sale. In short, a journal must record every transaction.

Step 3: Posting

Once the journal entry records the transaction, it must post to an account in the general ledger. The General ledger summarizes all accounting actions by account. The general ledger accounts are buckets for your transactions. such as;

- Professional Services Expense

- Cash Account

- Accounts Payable

- Receivables

- Cost of Goods Sold (COGS)

Moreover, A general ledger can now track financial positions and statuses by account.

Step 4: Generating unadjusted trial balance report

The fourth accounting cycle step is calculating a trial balance. It is done at the end of the accounting period. Moreover, A trial balance informs the business of the unadjusted ratios in each account. After that, it is taken through to the fifth phase for testing and analysis. It follows the accounting period’s end and finds records.

Furthermore, it posts all transactions to the journal. This stage guarantees that the total credit balance and debit amount are equal. If those values do not match, this stage can catch many errors.

Step 5: Preparing worksheets

Worksheets are useful for analyzing, identifying, adjusting and combining entries. Worksheets make it easier to complete the work at the end of the accounting period. Moreover, worksheets help to avoid errors in the permanent accounting record. If an error occurs on the worksheet, it is simple to correct. Use your accounting system’s skills whenever possible. In an accounting cycle diagram, resolve each balance sheet account at least once a month. Its purpose is to find and correct mistakes by adjusting journal entries. Review the journal cash account for each bank’s accounting statement. List all the unpaid invoices, including uncleared deposits and bank service charges. It is under the section of cash resolving items.

Step 6: Preparing to adjust entries

A bookkeeper makes changes in the sixth step. A bookkeeper makes adjustments to journal entries if needed. Create adjusting journal entries to fix any errors. Moreover, represent any differences found when combining balance sheet accounts. It is necessary to review and approve journal entries. As part of the accounting control process, total debit balances should equal total credit balances. It is after entering and posting access to the general ledger. You can confirm this by running and reviewing an adjusted trial balance report.

Step 7: Generating financial statements

In the seventh step, the company generates its financial statements after making all adjusting entries. Most businesses will have an income statement, a balance sheet, and a cash flow statement if you want to create financial statements for the accounting period. Therefore, You need to select your customized financial reports. However, many accounting systems help you to set up your financial information. For public companies, the SEC requires quarterly financial reporting. Before issuing financial statements, review and approve their management.

- A company’s financial statements include the following:

- Balance sheet

- Statement of owner’s equity

- Income statement

- Statement of cash flows

The balance sheet accounting equation is funds minus debts equals owner’s share.

Step 8: Closing the Books

In the last step, a company completes the accounting cycle. It is by closing its books at the end of the day on the specified deadline date. The closing statements provide a report on the period’s performance. At the end of the time, a business use closing entries to complete temporary accounts, revenues, and expenses. These closing entries include converting net income to maintain earnings. Finally, a business prepares the post-closing trial balance. It ensures that the debits and credits match and the cycle can start again. After closing, the accounting cycle diagram begins all over again with a new reporting period.

Purpose of accounting cycle diagram

The accounting cycle diagram aims to track all money coming and leaving a business. That is why balancing is so important. Moreover, the accounting cycle diagram gives businesses the chance to improve performance.

Accounting Assignment Helper in UK

The accounting cycle method is used to record a company’s accounting transactions. Accounting cycles are one of the most important accounting thesis subjects. But it is also a very deep and complex subject. Due to its complex and detailed aspects, it can be hard for students to understand every topic simultaneously. It results in not completing the projects, assignments, and homework assigned to them. Thus, you no longer need to worry. Accounting Assignment Helper in UK expert tutors are available to help you. We are available 24 hours a day, seven days a week, to help the students. The accounting cycle diagram is a difficult topic that many students struggle with. However, our team use study material that is simple to understand. It will also help students in their test preparation.

Services we offer

Accounting Assignment Helper UK helps students with their accounting cycle diagram 24 hours daily. And even seven days a week. Therefore, You can depend on us whenever you need urgent help in any subject, such as Accounting, Finance, Management, Economics, Statistics, or Computer Science. Accounting Assignment Helper UK promises to complete the work on time. We promise to produce 100% original work at a very reasonable cost. We have experts available all hours of the day and night.

Moreover, we will help you with the accounting cycle diagram. We are ready to work on your assignments and projects and assist you in getting good grades. You can get the best online help from our dedicated team, researchers, and professors. The solutions we provide will be 100% original and accurate.

Read Also : Best Dissertation Topic Ideas for Business Management